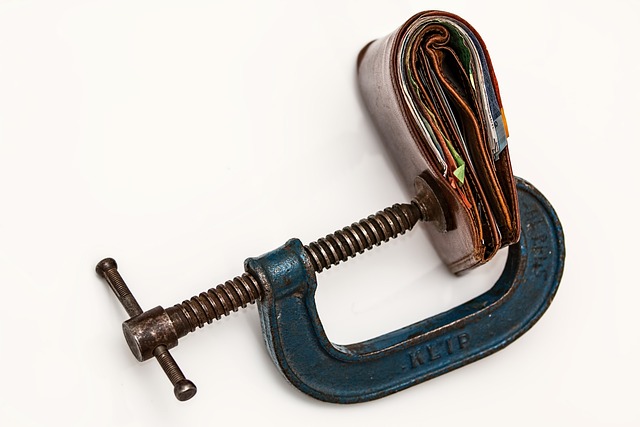

“Financial stress can be defined as difficulty meeting basic financial commitments due to a shortage of money. Financial stress can negatively impact an individual’s health and psychological well-being.” 1

The typical causes of financial stress are the current economic climate, concerns with rising living costs, rising inflation, and increasing interest rates.

According to the 2022 AMP Financial Wellness Report, it is not only people on low-income suffering but one in five employees earning over $100,000 per annum are experiencing financial stress.

Other findings include the following;

- 19% of women were ‘severely or moderately financially stressed’

- 18% of part-time workers were ‘severely or moderately financially stressed’

- 13% of single parents (aged 30 – 44) were severely or moderately financially stressed. A more recent report indicates that this figure currently may be as high as 25%

- 59% of Australians aged over 65 are worried about their debt levels

- 26% of Australians over 65 feel guilty about their personal finances and worry about their financial security.

What to do if you feel financially stressed

Over the past two years, some workers have been responding to these financial challenges. Younger workers are simplifying their finances by cutting their spending, re-evaluating their financial priorities, and setting personal financial goals.

If we cannot do anything about our income, we need to focus on our discretionary spending.

Young families are now prioritising their mortgages and selling down on their investments or assets as they increase in value. Typically, younger families are looking to increase the cash in their mortgage offset account. Not only does this strategy assist them in indirectly reducing their mortgage, but it also helps them to reduce their income tax.

Retirees

Many retirees feel they will have to retire with less investment and pension assets or work longer before retiring.

Arguably this is the category that is affected the most by these prevailing economic conditions. For retirees, as they are not working, their only source of income is from their investments or Government support. Their only option is to cut spending. Many retirees have already adjusted their discretionary spending. One of the last remaining categories is their utility bills. With energy prices rising, this is becoming more and more difficult to achieve.

45% of retirees follow a budget and are very mindful of their spending habits.

44% have significantly reduced their spending over the past two years.

34% are reviewing their utility bills and trying to service a cheaper deal.

Should you require further information in relation to managing your finances, please feel free to contact Peter Quinn by submitting an enquiry or calling us on +61 2 9580 9166 to book an obligation-free appointment.

1 Financial stress – Department of Education, Australian Government

The information in this document does not take into account your personal objectives, financial situation or needs and so you should consider its appropriateness having regard to these factors before acting on it. It is important that your personal circumstances are taken into account before making any financial decision and it is recommended that you seek assistance from your financial adviser.