Protection of assets. Many business owners choose to operate their business through a corporate structure. Running a business can be fraught with pitfalls and risks, particularly during times of high inflation. Separating your business and personal assets helps to segregate your business risks away from your personal assets. The business risk could involve a lawsuit […]

What impact would a traumatic event have on you and your family? Trauma events encompass severe medical conditions that have the potential to affect the well-being of you or your loved one. These include conditions like: Conditions like cancer and strokes can strike without warning, affecting the person facing the illness and the entire family. […]

With more taxpayers working from home, you are no doubt aware that you can claim a fixed rate tax deduction of 67c per hour. Unlike previous years this fixed rate amount includes the additional running expenses you incur, such as; Please ensure that you do not claim the 67c per hour and the above running […]

Many baby boomers are asset-rich and cash-flow or income-poor. You may be aware that a number of years ago, the Federal Government introduced the ‘downsizing contribution’ into superannuation. The concept of this concession was to allow homeowners to contribute $300,000 into their superannuation fund when they sell their home, subject to certain conditions. Originally in […]

Many investors with an investment property have an investment home loan with a redraw account attached. The benefit of the redraw account is that if you need money, for example, to repair or replace a bathroom or kitchen, the interest on this redraw component of the loan is also tax deductible, as the loan was […]

Repairs and maintenance are tax-deductible expenses, yet improvements to the property or capital works or replacement of items are not tax deductible. Deductions claimed for repairs, and maintenance are an area that the Tax Office always looks closely at, so it’s important to understand the rules. An area of major confusion is the difference between […]

The ATO is targeting investment property owners – what you need to know. The ATO believes there is a shortfall in tax revenue of around $1 billion dollars due to property investors over-claiming tax deductions or under-declaring the assessable rent. Rather than relying solely on the information presented in the self-assessed income tax return, the […]

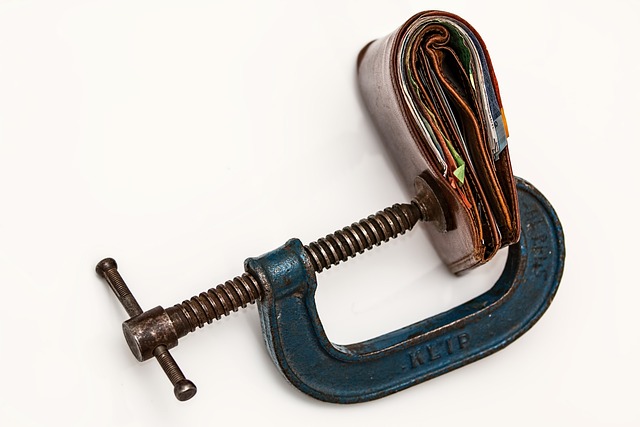

“Financial stress can be defined as difficulty meeting basic financial commitments due to a shortage of money. Financial stress can negatively impact an individual’s health and psychological well-being.” 1 The typical causes of financial stress are the current economic climate, concerns with rising living costs, rising inflation, and increasing interest rates. According to the 2022 […]

From 1 July 2022, the Australian Taxation Office (ATO) advised that a taxpayer can calculate and claim a tax deduction for working from home expenses by either of two methods. The simplest method is the revised fixed rate method. To use this method, you must; This revised fixed rate method entitles you to claim a […]

With interest rates rising, energy prices increasing, and the well-publicised difficulty in recruiting and retaining staff, many business owners and CEOs feel alone and/or outside their comfort zone. We are currently experiencing unsettled times. According to some forecasters, the Australian economy faces a 40% chance of a recession over the coming 12 months, and they […]